Resale Value Factors: What Makes South Delhi Properties Appreciate

South Delhi has long been synonymous with premium real estate and exceptional property resale value. As one of India’s most coveted residential destinations, understanding what drives South Delhi appreciation can help investors maximize their real estate ROI. Whether you’re a first-time buyer or a seasoned investor, knowing these key factors will guide you toward making informed property decisions that stand the test of time.

Why South Delhi Remains a Prime Investment Destination

The property market in South Delhi has consistently outperformed many other regions in Delhi NCR, making it a preferred choice for those seeking strong property resale value. The area’s unique blend of historical significance, modern infrastructure, and strategic location creates a perfect storm for sustained South Delhi appreciation.

Over the past decade, properties in prime South Delhi locations have shown remarkable resilience even during market downturns. This stability, combined with steady growth, makes South Delhi an attractive proposition for investors looking to optimize their real estate ROI.

Location-Specific Factors Driving Property Values

Proximity to Central Business Districts

One of the most significant factors contributing to South Delhi appreciation is the area’s strategic proximity to major business hubs. Properties located within easy reach of Connaught Place, Gurgaon, and emerging business districts like Aerocity command premium prices and show better appreciation rates.

Areas like Greater Kailash, Lajpat Nagar, and Defence Colony benefit immensely from their connectivity to these commercial centers. The shorter commute times translate directly into higher property resale value, as working professionals are willing to pay a premium for convenience.

Metro Connectivity and Transportation Infrastructure

The Delhi Metro network has been a game-changer for South Delhi appreciation. Properties within walking distance of metro stations have consistently shown superior real estate ROI compared to those requiring additional transportation to reach metro connectivity.

The Pink Line and Violet Line have particularly benefited South Delhi properties, with areas like Lajpat Nagar, Moolchand, and Kalkaji experiencing significant value appreciation. Future metro expansions continue to be a key factor investors should consider when evaluating property resale value potential.

Educational Institution Proximity

South Delhi’s reputation as an educational hub significantly impacts property resale value. The presence of prestigious schools like Delhi Public School, Vasant Valley School, and numerous coaching institutes creates constant demand from families prioritizing education.

Properties near these educational institutions not only command higher rental yields but also show consistent South Delhi appreciation due to sustained demand from parents seeking convenient access to quality education for their children.

Infrastructure Development and Its Impact

Road Network and Connectivity Improvements

The continuous improvement of South Delhi’s road infrastructure plays a crucial role in determining property resale value. Recent developments like the Eastern Peripheral Expressway and ongoing flyover constructions have enhanced connectivity, directly impacting property values in the benefited areas.

Well-maintained roads, proper street lighting, and efficient traffic management contribute to the overall desirability of a location, thereby supporting South Delhi appreciation. Areas that have benefited from recent infrastructure upgrades often see immediate positive impacts on their real estate ROI.

Utilities and Civic Amenities

Reliable power supply, water availability, and efficient waste management systems are fundamental factors that influence property resale value in South Delhi. Areas with better civic amenities consistently outperform those with infrastructure deficits.

The presence of parks, community centers, and recreational facilities adds to the overall appeal of a locality, contributing to sustained South Delhi appreciation. Investors should prioritize properties in areas with comprehensive civic infrastructure for optimal real estate ROI.

Market Demographics and Demand Patterns

Target Buyer Profile Analysis

Understanding the typical buyer profile in South Delhi helps explain the factors driving property resale value. The area attracts affluent professionals, business owners, and established families who prioritize quality of life and convenience.

This demographic typically values premium amenities, security, and social status associated with South Delhi addresses. Properties that cater to these preferences tend to show better South Delhi appreciation over time, making them excellent choices for investors focused on maximizing real estate ROI.

Rental Yield Considerations

The strong rental market in South Delhi provides dual benefits to property investors. High rental yields not only generate immediate returns but also indicate strong demand, which supports long-term property resale value.

Areas with consistent rental demand from corporate professionals, embassy staff, and students typically show more stable South Delhi appreciation patterns. This demand stability is crucial for investors seeking predictable real estate ROI.

Property Type and Architectural Preferences

Independent Houses vs. Apartments

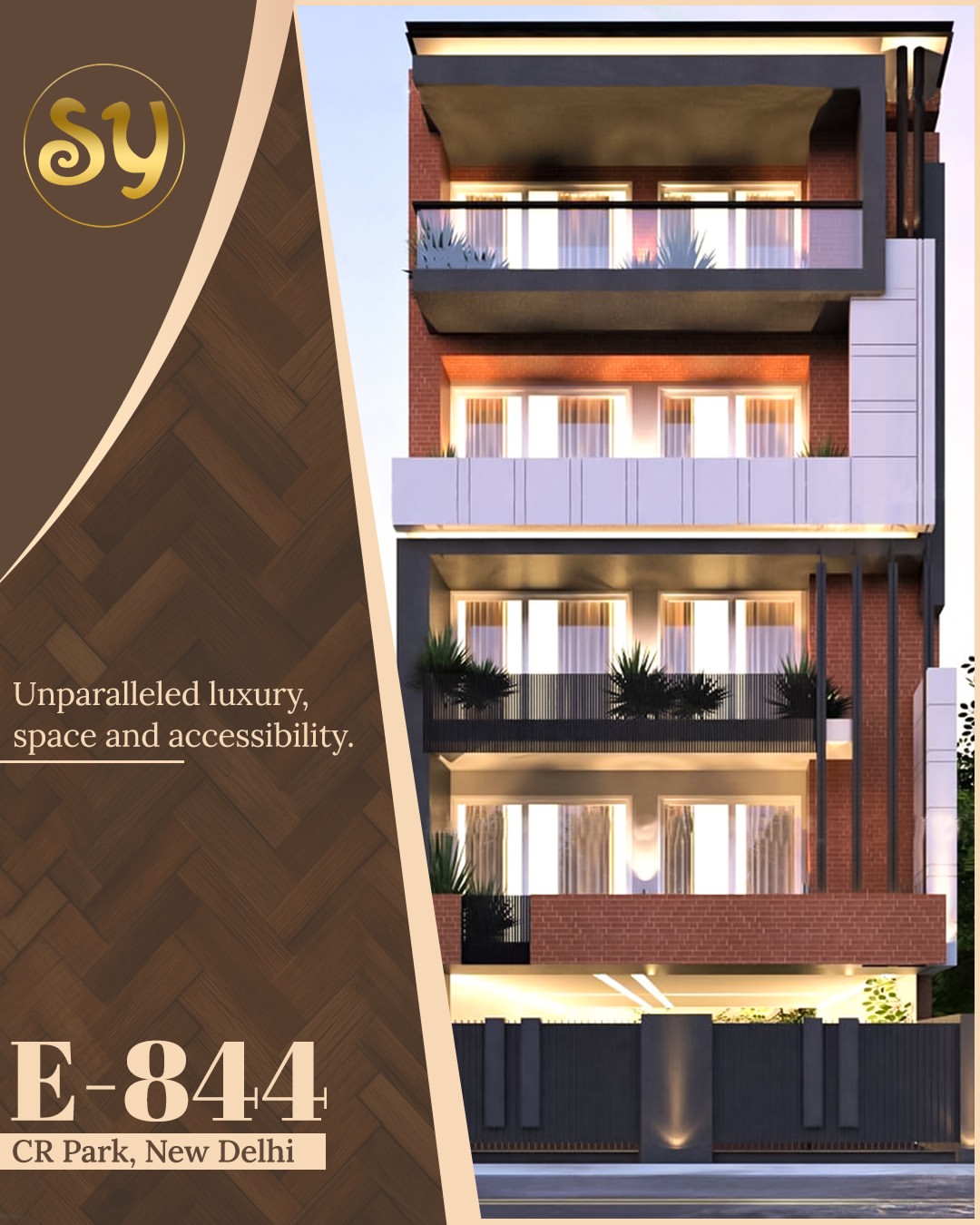

The type of property significantly influences property resale value in South Delhi. Independent houses, particularly in established colonies like Defence Colony, Greater Kailash, and Vasant Vihar, command premium prices due to their exclusivity and privacy.

However, well-designed apartment complexes with modern amenities are also showing strong South Delhi appreciation, especially among younger buyers who prefer maintenance-free living. The key is understanding the target market’s preferences in specific micro-markets.

Modern Amenities and Smart Home Features

Properties equipped with modern amenities like swimming pools, gyms, security systems, and smart home features are increasingly commanding higher property resale value. As lifestyle preferences evolve, these features become essential rather than luxury additions.

Investors focusing on properties with contemporary amenities are likely to see better South Delhi appreciation as these features become standard expectations among buyers, directly impacting real estate ROI.

Economic Factors Affecting Property Values

Interest Rate Sensitivity

Property markets, including South Delhi, are sensitive to interest rate fluctuations. Lower interest rates typically boost demand, leading to improved property resale value across the region.

Understanding interest rate cycles and their impact on buyer behavior can help investors time their purchases and sales for optimal real estate ROI. Properties in prime South Delhi locations tend to be less sensitive to rate fluctuations due to strong underlying demand.

Economic Growth and Employment Trends

The overall economic health of Delhi NCR directly impacts South Delhi appreciation. Areas with diverse economic activities and employment opportunities show more resilient property values during economic downturns.

South Delhi’s proximity to major employment centers and its own commercial activities provide a buffer against economic volatility, supporting consistent property resale value growth over time.

Government Policies and Regulatory Environment

Development Regulations and FAR Policies

Government policies regarding Floor Area Ratio (FAR) and development regulations significantly impact property resale value in South Delhi. Areas with favorable development norms tend to show better appreciation potential.

Recent policy changes allowing increased FAR in certain areas have positively impacted South Delhi appreciation, as developers can create more valuable projects within the same land area, ultimately benefiting existing property owners.

Tax Implications and Incentives

Property taxation policies and available incentives play a role in determining real estate ROI. Understanding the tax implications of property ownership, including capital gains treatment and deduction opportunities, is crucial for maximizing returns.

Recent changes in property tax structures and registration costs have varying impacts across different South Delhi micro-markets, affecting overall property resale value calculations.

Environmental and Lifestyle Factors

Green Spaces and Environmental Quality

The availability of parks, green belts, and good air quality significantly influences property resale value in South Delhi. Areas like Lodhi Gardens vicinity and properties near Delhi Ridge show premium pricing due to their environmental advantages.

Environmental consciousness among buyers is increasing, making properties with green features and proximity to natural spaces more attractive, contributing to sustained South Delhi appreciation.

Social Infrastructure and Community Living

The presence of clubs, community centers, places of worship, and social gathering spaces adds to the overall appeal of South Delhi properties. These factors contribute to the lifestyle quotient that buyers associate with the area.

Properties in well-established colonies with strong community infrastructure tend to show better real estate ROI due to their appeal to families and long-term residents.

Future Growth Prospects and Investment Opportunities

Upcoming Infrastructure Projects

Several infrastructure projects planned for South Delhi will likely impact future property resale value. These include metro line extensions, road widening projects, and smart city initiatives that will enhance the area’s appeal.

Investors who identify and invest in areas that will benefit from upcoming infrastructure developments are positioned to achieve superior South Delhi appreciation and real estate ROI.

Emerging Micro-Markets

While established areas continue to show steady growth, emerging micro-markets within South Delhi offer opportunities for higher returns. Areas undergoing transformation or benefiting from new infrastructure developments present attractive investment prospects.

These emerging locations often provide better entry points for investors while still offering the fundamental advantages that drive South Delhi appreciation.

Strategic Investment Recommendations

Timing Your Investment

Understanding market cycles is crucial for maximizing property resale value. South Delhi’s property market has shown distinct patterns that savvy investors can leverage for optimal returns.

The best real estate ROI often comes from identifying the right time to enter the market, considering factors like interest rates, supply levels, and economic conditions.

Due Diligence Essentials

Before investing in South Delhi properties, conducting thorough due diligence ensures you’re making informed decisions that will support long-term property resale value. This includes verifying legal documentation, understanding local development plans, and assessing the property’s condition.

Proper due diligence helps identify properties with the strongest potential for South Delhi appreciation while avoiding common pitfalls that could negatively impact real estate ROI.

Conclusion: Maximizing Your South Delhi Property Investment

The factors driving property resale value in South Delhi are multifaceted and interconnected. From location and infrastructure to demographics and government policies, understanding these elements helps investors make informed decisions that maximize their real estate ROI.

South Delhi appreciation will likely continue to be supported by the area’s fundamental strengths: strategic location, excellent infrastructure, strong demographics, and lifestyle appeal. Investors who focus on properties that excel in multiple value-driving factors are best positioned to benefit from this ongoing appreciation.

Success in South Delhi’s property market requires a comprehensive understanding of local dynamics, careful property selection, and strategic timing. By considering all the factors discussed in this analysis, investors can build a portfolio that delivers strong property resale value and sustainable real estate ROI over the long term.

Whether you’re looking to buy your first property in South Delhi or expand an existing portfolio, focusing on these key appreciation factors will help ensure your investment decisions align with market fundamentals and long-term value creation opportunities.